Restarting Your Financial Journey And Aiming For A Brighter Future

Sun Life Philippines’ Sun Talks Provides Insights on How to Restart Your Financial Journey Through Careful Financial Planning

Many Filipinos are financially illiterate because they’re afraid of financial planning. The thought of dying and leaving loved ones has always been a hard topic to think of or discuss. What they don’t realize is that they’ll be doing their families a great deal of good if they have life insurance and thus, leave money behind.

#RestartingYourFinancialJourney is never too late through proper planning aimed towards financial stability.

Sun Talks Event

I attended another Sun Talks online event by Sun Life Philippines last July 6. Guest speakers Valerie Lagarde (Sales Cluster Head – Manila 3A) and Andrea de Guzman (Unit Manager and Financial Advisor) were able to impart valuable knowledge on restarting your financial journey.

Financial Planning at Different Life Stages

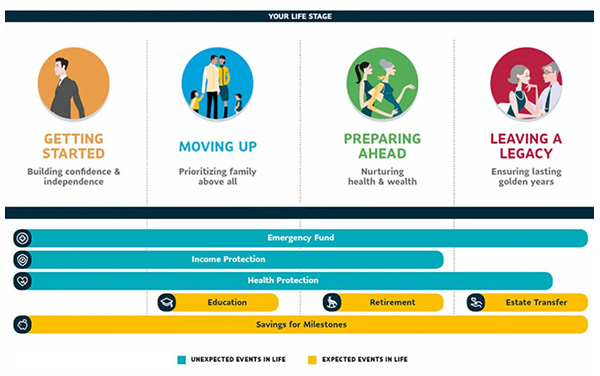

Starting the discussion was Ms. Valerie Lagarde who emphasized the value of financial planning to many people including breadwinners, parents, those who want to start families, and those generating income. She then discussed the different stages of life and the need for financial resources at every stage.

⯈ Getting Started: Building Confidence & Independence

You are establishing your independence. It is the time of new responsibilities, and you’re beginning to understand the value of handling your own finances. Investing for experiences that enrich your life is the ultimate purpose of the money you earn, and this empowers you to dream bigger.

⯈ Moving Up: Prioritizing Family Above All

Gone are the days of YOLO (‘you only live once’). You are shedding old habits to pave the way for life-changing events like getting married, cradling your newborn child, or nurturing a home. Having dependents prompt you to diversify your finances beyond the usual savings.

⯈ Preparing Ahead: Nurturing Health & Wealth

Two forces compel and inspire you to invest for the future: preparing for retirement while attending to your own health and wellness. You look out for both your capacity to be healthy and your means to be wealthy. You seize chances to make your money work even harder through a diversified portfolio.

⯈ Leaving a Legacy: Ensuring Lasting Golden Years

Gone are the days when retirement means passively watching the world go by. Instead, you relish the freedom to pursue new dreams, devote more time to loved ones, and make a difference in your community. Aside from having a comfortable financial nest, you are also focused on the smooth transfer of your estate to your heirs.

She also said that an emergency fund, education savings, income protection, health protection, estate transfer, savings for milestones, and retirement planning are all important.

Money For Life

Money for Life is the Sun Life way of helping you create your own personalized financial plan, based on the different stages of your life.

To have Money for Life means enjoying the financial freedom to live your life as you choose, because you are prepared for the expected and unexpected, events in your journey.

Financial Planning Pyramid

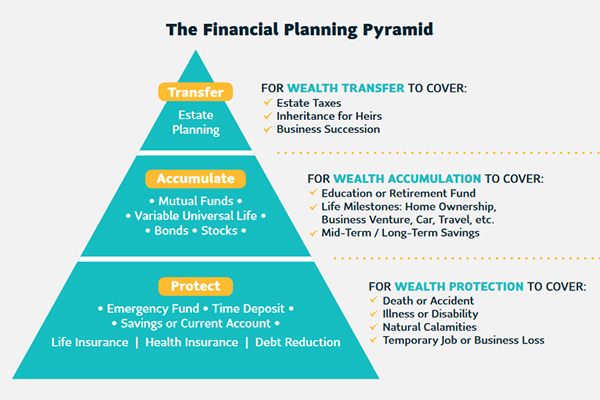

The Financial Planning Pyramid consists of three essential levels (starting at the bottom and advancing upward step by step).

-

⯈ Liquidity and Wealth Protection

This entails checking cash inflows and obtaining investments and insurance policies. Wealth protection covers illness or disability, death or accident, temporary job loss, and natural calamities.

⯈ Accumulate

This focuses on money accumulating over time through savings and investments. Wealth accumulation covers home ownership, business venture, travel, savings, car, education or retirement fund, and life milestones.

⯈ Transfer

This level touches on leaving a legacy and making sure that wealth, estate, and business is inherited by rightful heirs.

How Insurance Can Help in the Achievement of Financial Goals

Ms. Andrea de Guzman discussed how important insurance is and how it can be an instrument for people to reach their financial goals. She said life and health insurance are both important because of life’s uncertainties and that gradually building wealth is valuable.

Ms. De Guzman also said that it’s never too late to restart your financial journey and #SunLifePartnerForLife will always be there to help disseminate information to Filipinos regarding financial planning, eventually achieving a more favorable financial future.

Sun Life Philippines: Your Partner for a Brighter Future

Sun Life in the Philippines offers a diverse range of insurance, wealth, and asset management solutions to help every Filipino in their journey towards a brighter life.

As the country’s first and longest-standing life insurer, they provide:

- Financial planning and guidance

- Life insurance products for every life stage

- Investment products for individuals, families, and companies

- Health-focused products with an innovative wellness community

- Exceptional client-servicing

For more information, please visit www.sunlife.com.ph.